Is the convenience of paying your PEO really worth it?

If your business is using a PEO (Professional Employer Organization) or if your organization has ever considered using a PEO, take 8 minutes and read this blog.

This blog is not intended to go into the details of a PEO, the services they provide to companies, or the pros and cons of contracting with a PEO. However, just as a quick review, a PEO is an employee leasing organization working with small and medium-sized businesses to assist with managing payroll, payroll-related taxes, certain human resource functions, access to benefits and other employer-related functions necessary to running a business. Once one has an understanding of a PEO, it is not too difficult to grasp the overall value of the services provided by a PEO, but it does become hard to determine if the continuous cost for these services, year after year, is really worth the value (or perceived value) gained versus self-managing the various business functions the PEO is handling for an organization.

To get started, let’s look at a PEO in a completely different way. Try to envision the services of a PEO in terms of a food service that provides meals for your family (e.g. breakfast, lunch and dinner). Some families are very attracted to the convenience of having someone else be responsible for handling their meals. This type of service eliminates the need to determine what to cook for each meal, how much to cook, whether or not you need particular equipment to prepare and cook the food, shopping for the ingredients, or possessing any knowledge about cooking meals (e.g. methods of cooking, nutritional information, dietary restrictions, meal variety, etc.). We could even add that maybe one of the best conveniences of using a food service is by eliminating the dreaded clean-up aspect of making a meal in your own kitchen. Using a food service is fairly straightforward, you just order from the menu, pay the associated cost and everything is taken care of by the food service provider. Or, in our analogy, a small or medium-sized business can contract for certain business services to be provided by the PEO and they, in theory, handle all the rest.

For a period of time and under certain circumstances, using a food service is a logical and even a good, potentially long-term, decision. However, at some point, it may no longer make financial sense to continue to pay for the meal service (e.g. children grow up and leave home, a family member decides to be at home more, service rates continue to increase, etc.). It becomes something extravagant or lavish, not necessary or essential. The same is true for businesses who, for whatever reason, chose to use a PEO. There comes a time when the convenience of using the PEO may feel more like a luxury than a necessity. It’s hard to provide a precise answer, but typically firms with more than a few hundred employees should be taking a hard look and really comparing the costs and services of their current PEO against a combined approach of employing internal HR/Payroll professionals, a cloud-based technology partner and a full-service benefit and insurance broker. This combination might just be a better, more cost effective alternative.

By far, the biggest downside to either eating out or paying a service to provide meals for your family, rather than cooking at home, is the higher costs per meal and eventually the exorbitant costs spent over time. Even though 175,000 U.S. businesses use a PEO, stated by the National Association of Professional Employer Organization, the vast majority of U.S. businesses (approximately 32 million) manage and pay their employees with their own internal HR and payroll teams using some sort of software technology solution and partnering with a full-service benefits broker. Said a different way, most businesses are willing to buy the ingredients and utensils, prepare and make their own meals from home, rather than eat out or pay a service to provide them with meals on an on-going basis. Why is that? In our opinion, it’s a combination of costs, control, and quality of service. And of these three, and as you can probably gather, the primary driving force for families to stop using a food service, or for businesses to transition away from their PEO, is the significant costs savings. We’re not going to sugarcoat it, leaving a PEO can be a bit of a challenge. But, when done correctly, it can be well worth it.

Top Reasons Businesses Leave Their PEO

1. Cost Savings

2. Enhancements to Benefits and Insurance

3. Enhancements to Technology

Reason # 1 – Cost Savings

It’s important to understand the fees and costs associated with PEO billing. There are two common price structures or methods PEOs charge clients for their services:

- Percentage of Overall Payroll (POP): this is a percentage of total gross payroll, bundled together with State and Federal taxes and other costs (e.g. workers’ compensation, liability insurance, health insurance, benefits, retirement plans, etc.). Fees are typically in the 2% – 6% range of total gross payroll.

- Per Employee Per Month (PEPM): this is a flat, more transparent monthly fee in the range of $75 – $225 PEPM.

Note: regardless of the billing method, most PEOs include (6) standard costs (whether they are bundled or not) sometimes referred to as ‘pass-through” costs (i.e. FICA, FUTA, SUTA, Workers Compensation, Employee Benefits Premiums, Administrative Fees).

Other PEO billable fees include services for HR consulting, a technology platform or software to manage employee and business functions (e.g. employee HR data, time collection, payroll processing, tax management, health benefits, retirement services, regulatory compliance assistance and even call center support).

Let’s go through both PEO billing models using some general estimates in order to determine the normal annualized costs charged by a PEO. Both of these scenarios will exclude additional PEO fees beyond the 6 standard costs mentioned earlier.

PEO Billing Model Scenario

- Company size: 300 active employees

- Payroll pay cycle: semi-monthly

- Average annualized employee pay: $63,179*

- Average employee paycheck**: $2,632

* this is a National average and could vary greatly by region and industry

** based on semi-monthly pay approach (24 paychecks per year)

⇒Percentage of Overall Payroll (POP) Method

-

- 300 employees paid semi-monthly

300 x $2,632 = $789,738 overall payroll - 4% POP fee

$789,738 x 4% = $31,590 per payroll PEO fee - Annualized PEO Service Fee: $31,590 x 24 payrolls = $758,148

- 300 employees paid semi-monthly

The POP pricing method is common for PEO vendors such as ADP TotalSource.

Note: When any employee receives a pay increase or a bonus check, so does the PEO. Keep in mind that this method is not advantageous for organizations with large amount of commissions or bonuses paid out to employees. PEOs benefit when the employer payroll increases as the PEO takes a percentage of the overall payroll.

⇒Per Employee Per Monthly (PEPM) Method

-

- 300 employees

- $150 PEPM fee

300 x $150 = $45,000 per month - Annualized PEO Service Fee: $45,000 x 12 months = $540,000

This PEPM pricing method is common for PEO vendors such as TriNet, Insperity and Sequoia.

Note: The PEPM pricing method is fixed or a flat rate and does not fluctuate up or down with your payroll. PEOs will only benefit when the company grows and hires more staff.

Another item to mention is that in both billing models, the PEO gets the benefits of all pre-tax benefits and tax credits (i.e. Section 125 Benefit Plans or Work Opportunity Tax Credits). Neither of these savings are passed on to the customer and are retained by the PEO.

PEO Costs Compared to Internal Self-Management Organizational Costs

In order to compare the costs of a PEO versus internally administering the same services provided by the PEO, we must first understand the resources and services needed in order to perform a true apple to apples comparison.

To manage and administer the PEO services internally, a combination of internal human resources, some type of human capital management technology or software, and a full-service benefits broker is needed. For our scenario, the following list of resources and services will be used in order to do an apple to apples comparison.

- HR and Payroll Resources/Personnel

- Technology Platform/Software Solution

- HRIS

- Payroll

- Tax Management

- Time and Labor Management

- Talent Management

- Employer Handbook and Policy Manual(s)

- Employee Training Content: EAP, Safety Manual, or Employer Compliance Services

- Employee Call Center

- Employee Records Maintenance: I9, FLSA, OSHA, EEO, VETs, ADA, ADEA, etc.

- Benefits Administration: enrollment support, employee benefits call center, invoice reconciliation, ACA, HIPAA, FMLA, etc.

These following items are being excluded since they are billed as part of the overall PEO administration fees.

- Health Benefits (e.g. medical, dental, vision, LTD, STD, HSA, FSA, retirement and 401k)

- Workers Compensation

- Employment Practice Liability Insurance (EPLI)

- Administrative Services (i.e. 401K, FSA, HSA, COBRA, FMLA and leave administration, I-9 processing)

The best way to compare the PEO costs to self-managing is to break it down into 3-parts

- Part A = The Technology

- Part B = Staff Resources

- Part C = The Benefits and Insurance

Part A – The Technology

Mid-market HRMS/HCM technology solution suites are most commonly comprised of functionality for HR, payroll, tax management, time and labor, scheduling and talent management.* The subscription cost for this type of integrated system will range between $20-$28 PEPM.

* A detailed explanation pertaining to the differences between types of HRIS systems (i.e. HRIS. HCM, and HRMS) can be found here.

Areas included with a HRMS/HCM subscription technology solution: Digital I-9 processing, ACA management, Federal compliance reporting, benefits administration, a tax specialist, a benefits open enrollment specialist, and some training content delivered via an LMS platform.

- 300 employees

$26 PEPM x 300 employees = $7,800 per month - Annual Subscription Fee: $7,800 per month x 12 months = $93,600

- One-Time Implementation and Training Costs: $48,000

- Total 1st Year Investment: $93,600 + $48,000 = $141,600

Note: Compliance items Not included in HRMS/HCM vendor subscription fees, but can be added to the costs by utilizing either a full-service benefits broker or a third-party provider includes background checks, COBRA administration, unemployment compensation management (UCM), employee handbook and policy manual(s), and content focused on Federal compliance (e.g. sexual harassment).

Part B – Staff Resources

Depending on your geographical location around the U.S., salaries for employees can vary widely. In our scenario we are going to use national averages provided by Indeed. We are also going to use only two people resources for our business case even though The Society of Resource Management (SHRM) recommends the HR-to-employee ratio to be 1-to-100 (one HR/payroll full-time equivalent (FTE) staff for every 100 full-time employees.

- Average Base Salary for an HR Manager in the U.S = $72,397

- Average Base Salary for a Payroll Administer in the U.S. = $50,642

To keep it simple, we are going to add 30% to calculate the projected burden factor for estimated employee costs which will include employer taxes and benefits.

- HR Manager = $72,397 x 30% = $94,116

- Payroll Administer = $50,642 x 30% = $65,834

The total projected costs for staff resources would be $159,950 annually

Part A – Technology Costs = $141,600

Part B – Staff Resource Costs = $159,950

Part C – Benefits Costs = TBD

Total Costs for Technology and Staff Resources = $301,550

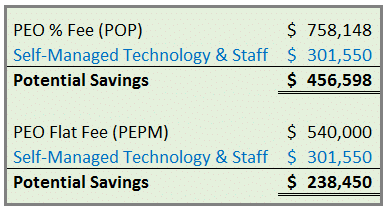

In the two PEO billing model scenarios above, the estimated annual PEO service costs were $758,148 for POP method or $540,000 for PEPM method. Even though the sample scenario may not be an exact service comparison from the PEO to the self-managed Technology and Staff Resources (Part A and Part B above), there is clearly a large opportunity to see why businesses leave their PEO and manage it themselves (see potential savings below).

Part C – The Benefits and Insurance

Projected costs for benefits and insurance is quite difficult because of all of the variables associated with the benefit provider, types of benefits, coverage, and deductibles. This is an area that a full-service benefit broker specializes in and can help with a cost analysis between the PEO benefit offerings compared to the brokers tailored benefits package. As a result, we are not going to provide costs or even attempt a good faith estimate for this part of the PEO versus self-managing cost calculation. Ultimately, you will need to know how the PEOs’ benefit and insurance costs differ from what the full-service benefit broker will charge, but with that component to the side there should be a significant financial saving opportunity to cancel a PEO contract.

Reason # 2 – Enhancement to Benefits and Insurance

Both benefit brokers and PEOs provide expertise with regards to benefits and insurance. In addition to providing benefits to their clients, a PEO also provides expertise and guidance in various business function areas (e.g. HR, payroll and compliance). They are both specialists in their respective industries. The question becomes which professional offers better coverage and better service, a PEO or benefit broker?

Unfortunately, there is no hard-and-fast or clear-cut answer. However, based on years of experience in the HR technology arena and implementing hundreds of clients with various people management software solutions, customers have time and time again expressed seeing significant value in using a full-service benefit broker to help personalize a select few benefits and insurance offerings as compared to a broad portfolio of 20+ plans typically offered by a PEO.

Here are a few key areas of using a full-service benefits broker over a PEO:

- Creating affordable, fully personalized benefit programs that are more targeted in design for their clients. PEOs offer a set of generic, multi-choice benefit options which can create confusion and is typically overwhelming to employees.

- Tailored communications and personalized educational meetings coupled with a dedicated broker team ensuring better employee engagement and satisfaction with both their employer and their benefits.

- Local onsite support for major events like benefit open enrollment.

- A diversified offering of both U.S. and global employee benefits including specialty health benefits (e.g. telemedicine, wellness vendors, enhanced employee communications, voluntary benefits, etc.).

- When necessary, having a global broker ensures consistent messaging, streamlines HR administration, and increases broker accountability. Additionally, a global broker can benchmark to each locale to ensure the right benefits are offered to the right employees.

- Enhanced EPLI (Employment Practice Liability Insurance) coverage as a stand-alone policy compared to that of a PEOs’ derived EPLI policy.

- Resources for wealth and asset management as well as retirement plan consulting. A broker will complete retirement plan assessments, offer strategies, conduct ongoing investment reviews, provide employee education and offer compliance support.

- Consulting advisement for general data protection, cyber and crime policies.

- Higher levels of expertise around benefits strategy consulting.

- Self-funding expertise and potential to save money with carriers.

- Additional support around wellness, employee communications and data analytics/underwriting.

Reason # 3 – Enhancement to Technology

Generally speaking, PEOs have done a reasonably good job of offering an intuitive application platform, especially in the areas of mobile capabilities and employee self-service. Unfortunately, one of the big downsides of using the PEOs’ software platform is that the software is very much an ‘out-of-the-box’, one-size fits all system typically designed for smaller organizations. This can be challenging as every business has a few novelties or uniqueness’ about the way in which they track, maintain and conduct business processes. In the HR technology marketplace today, there are numerous applications offering greater depth, breadth and flexibility with people management functionality.

Here are just a few functional areas of an HRMS/HCM solution that adds notable enhancements and greater value over a PEOs’ platform:

- Manager Self-Service

- Core HR/Payroll

- Talent Management

- Global

- Performance Management

- Career Development and LMS

- Succession Planning

- Recruiting and Onboarding

- Compensation and Salary Planning

- Workflow Design and Approval Processing

In closing, there are several additional reasons why businesses leave their PEO beyond the three primary reasons (i.e. cost savings, enhancements to benefits and insurance, and enhancements to technology) outlined above. Businesses may also terminate their PEO relationship due to cost surprises, poor service, lack of expertise, cultural differences, perceived value or international expansion.

It takes time, careful consideration, work and proper guidance from a knowledgeable benefit broker or other similar specialist to exit from your PEO. You will need to assess your current HR and people management related needs, conduct a thorough analysis of your current PEO services and associated costs, and create a detailed implementation plan to ensure a smooth transition. Remember, the decision to “get out” of the PEO relationship is more than just costs.

If you are unable to justify the escape from your PEO on costs, don’t forget about gaining back control and flexibility, the ability to enhance benefit offerings and the enrollment experience, providing a more robust and configurable people management technology tool, offering greater and more personalized people management functionality, improving company culture and boosting employee engagement. These types of changes are difficult to assign a monetary value, but rest assured they have a very big impact on your workforce. For most companies that make the transition away from their PEO, they will agree that the journey was challenging but well worth it in the end.