Understanding the Paycheck Protection Program

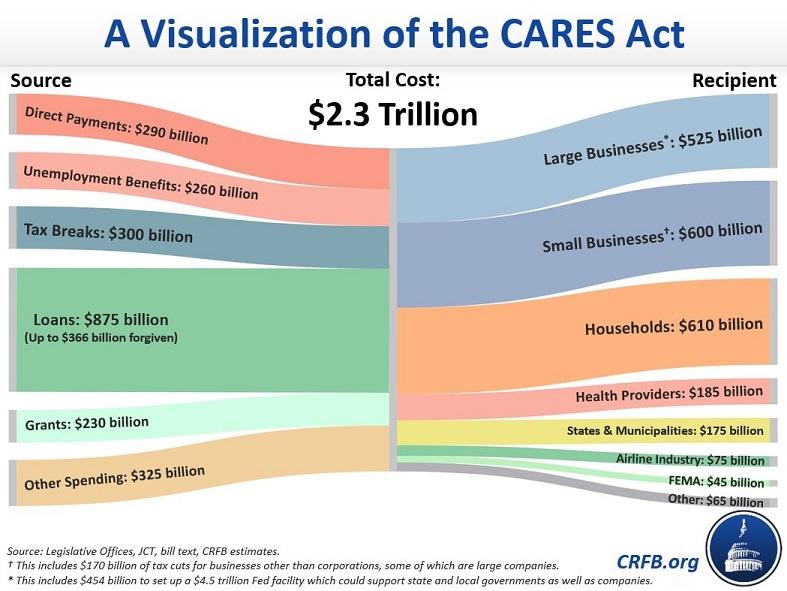

Americans are still digesting the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which passed on Friday, March 27 as the largest financial support package in U.S. history. The law is more than 800 pages and contains hundreds of provisions designed to dispense relief to individuals and businesses in the wake of the ongoing public health crisis. While Americans are becoming more familiar with the rebate portion of the bill, the legislation also supports small businesses and independent contractors.

It is evident that as more states continue to announce new quarantine and shelter-in-place orders; as countless companies face financial hardships and are forced into making tough business decisions regarding how to pay their normal business operating expenses, how to meet current and future payroll; whether to keep, lay off or furlough employees; small business owners across the Nation are seeking guidance as they apply for loans backed by the Small Business Administration (SBA).

The CARES Act, in an effort to assist organizations maintain cash flow, retain employees and to incentivize employers to maintain payroll during this crisis, includes the $349 billion Paycheck Protection Program (PPP). This loan program just might be the most promising portion of the legislation. With its low interest rate and forgiveness potential, the Paycheck Protection Program aims to sustain small businesses through this pandemic without burdening them with significant debt to pay off when the crisis has passed.

The PPP provisions of the CARES Act were further interpreted by the Small Business Administration in an interim final rule (the “Interim Rule”) issued late in the day on April 2, 2020. This news article has been updated to reflect that interim interpretation and to add some additional practical insights into the PPP program. The key updates from the Interim Rule are highlighted in purple text for ease of reference. The Interim Rule provided important information on the calculation of the loan amount, added some further requirements, and stated that additional guidance will be published on affiliate rules and on the calculation of the forgiveness amount. Businesses need to understand both programs as well as the additional financial and other relief (including an Emergency Relief loan program for eligible mid-size employers) that may be available under the CARES Act in order to make short- and long-term planning decisions. The CARES Act provides assistance to many businesses that may not meet the customary small business thresholds.

Overview of the Paycheck Protection Program

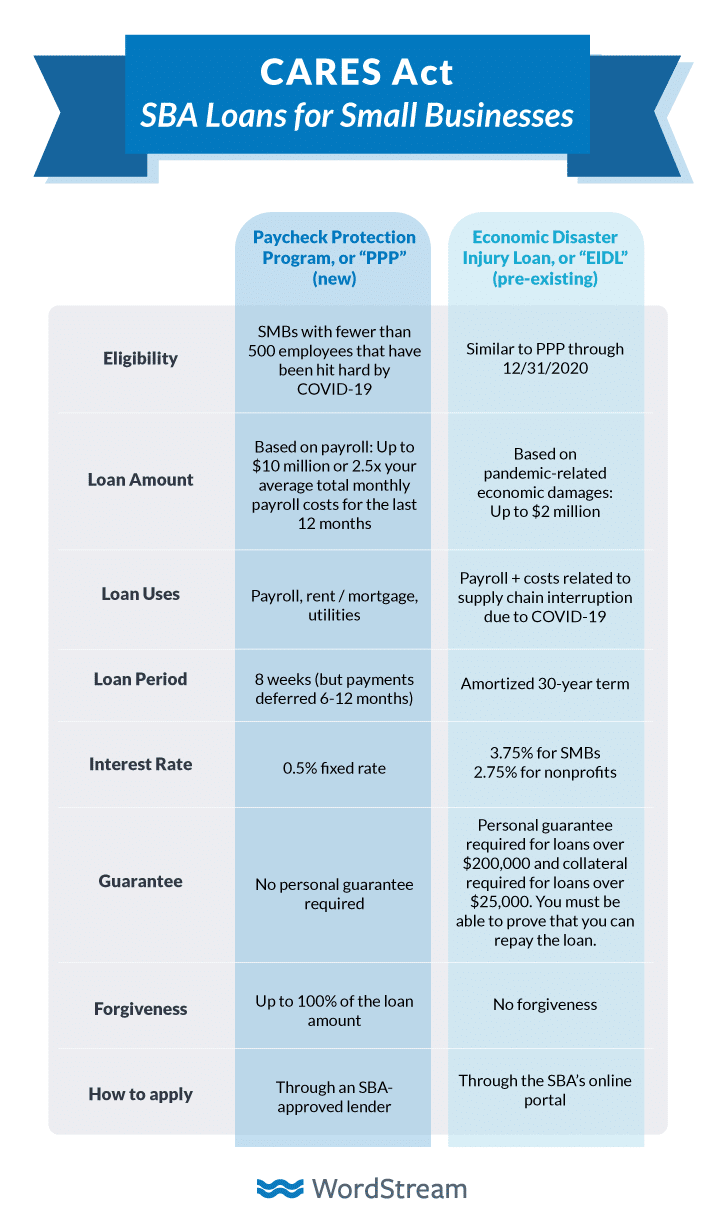

The Paycheck Protection Program is a SBA loan program specifically designed to help small businesses continue to make payroll at their staff’s current pay rate, as well as cover key expenses that keep the lights on (think mortgage/rent and utilities). Any of these 100% federally backed funds used for these express purposes during the loan’s eight-week period will be eligible to be forgiven; in other words, if a small business uses the loan as it’s intended, they will likely not have to pay back a penny. The PPP also waives all SBA fees and provides deferral on loan repayments for a minimum of six months up to a maximum of one year.

Small businesses impacted by coronavirus-related issues between February 15 and June 30, 2020 may apply for loans, which will remain available through the end of June. All 501(c)(3) nonprofits, 501(c)(19) veterans organizations, tribal businesses with fewer than 500 employees, individuals who manage a sole proprietorship, and independent contractors are eligible. Each entity is limited to one loan, determined by the applicable taxpayer identification number (TIN).

The loans are categorized by how long the organization remains operable from the beginning of the crisis period (February 15) to June 30. For businesses that continue to operate and retain employees over that period, the SBA can provide a maximum loan of 250 percent of the average monthly payroll costs during that period.

The Interim Rule clarifies that the PPP loans, to the extent not forgiven, will have:

- A 2-year term (decreased from the maximum maturity of 10 years under the Act),

- An interest rate of 1% (increased from prior Treasury guidance that set the interest rate at 0.5%)

- Principal and interest deferred for 6 months and no interest charged on forgiven amounts

Who can apply?

- This program is for any small business with less than 500 employees whose principal place of residence is in the United States (including sole proprietorships, independent contractors and self-employed persons), private non-profit organization or 501(c)(19) veterans organizations affected by coronavirus/COVID-19. This reference to United States residence is a new detail that was added by the Interim Rule, but not addressed in the CARES Act and possibly subject to further clarification by additional guidance.

- Businesses in certain industries may have more than 500 employees if they meet the SBA’s size standards for those industries.

- Small businesses in the hospitality and food industry with more than one location could also be eligible at the store and location level if the store employs less than 500 workers. This means each store location could be eligible.

When can I apply?

- Starting April 3, 2020, small businesses and sole proprietorships can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders.

- Starting April 10, 2020, independent contractors and self-employed individuals can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders.

- Other regulated lenders will be available to make these loans as soon as they are approved and enrolled in the program.

- The Interim Rule also makes it clear that the loans will be made on a first-come, first-served basis.

Where can I apply?

You can apply through any existing SBA lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating. Other regulated lenders will be available to make these loans once they are approved and enrolled in the program. You should consult with your local lender as to whether it is participating.

Visit www.sba.gov for a list of SBA lenders.

What do I need to apply?

You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender that is available to process your application by June 30, 2020.

Click HERE for the application.

What other documents will I need to include in my application?

You will need to provide your lender with payroll documentation.

Do I need to first look for other funds before applying to this program?

No. We are waiving the usual SBA requirement that you try to obtain some or all of the loan funds from other sources (i.e., we are waiving the Credit Elsewhere requirement).

How long will this program last?

Although the program is open until June 30, 2020, we encourage you to apply as quickly as you can because there is a funding cap and lenders need time to process your loan.

How many loans can I take out under this program?

Only one.

What can I use these loans for?

- The loans may be used for the following expenses/costs from February 15, 2020 through June 30, 2020:

- Payroll costs, including benefits

- Costs related to the continuation of group health care benefits during periods of paid sick, medical or family leave, and insurance premiums

- Employee compensation

- Mortgage interest obligations (but not principal)

- Rent and utilities

- Interest on debt incurred prior to the loan

- Refinancing of SBA EIDL loans that are made between January 31, 2020 and April 3, 2020

Note, however, that (i) the Interim Rule clarifies that at least 75% of the loan amount must be used for payroll costs and (ii) only a subset of these uses may be forgiven, as explained in more detail below. This is different from prior Treasury guidance, which did not require that 75% of the loan be used for payroll costs if they borrower was not seeking forgiveness. Certifications, including those carrying the penalties described above, must be made about the uses of the loan proceeds.

What counts as payroll costs?

- For a borrower other than an independent contractor, the sum of payments of any compensation with respect to employees, that is:

- Salary, wage, commission, or other similar compensation (not in excess of $100,000, prorated, and excluding any employee whose principal place of residence is outside of the U.S.)

- Cash tips or equivalent (not with respect to any employee whose principal place of residence is outside of the U.S.)

- Payment for vacation, parental, family, medical, or sick leave (other than qualified sick leave wages or qualified family leave wages under the FFCRA)

- Allowance for dismissal or separation

- Payment of group health care benefits and insurance premiums (generally, medical, dental, vision and health flexible spending account benefits)

- Payment of retirement benefits

- Payment of State or Local tax assessed on employee compensation (specifically excluding federal employment taxes, including the employee and employer share of FICA, Railroad Retirement Act taxes, and income taxes withheld from employees between February 15, 2020 and June 30, 2020)

- For an independent contractor, the sum of payments of any compensation or income of a sole proprietor or independent contractor that is a wage, commission, income, net earnings from self-employment or similar compensation (not in excess of more than $100,000 in 1 year, prorated).

The Interim Rule clarifies that independent contractors of a borrower do not count for purposes of the borrower’s PPP loan amount or forgiveness calculations. This was not clear from the face of the CARES Act, and should be considered by borrowers pursuing a PPP loan. Since independent contractors can also apply for a PPP loan, this appears to be a change to eliminate potential double counting.

How large can my loan be?

Loans can be for up to two months of your average monthly payroll costs from the last year plus an additional 25% of that amount. That amount is subject to a $10 million cap. If you are a seasonal or new business, you will use different applicable time periods for your calculation. Payroll costs will be capped at $100,000 annualized for each employee. The CARES Act and Interim Rule provide that average monthly payroll costs should be calculated over the 12-month period preceding the application, but the application form itself states that monthly payroll costs will be calculated using 2019 payroll costs for most applicants.

How much of my loan will be forgiven?

You will owe money when your loan is due if you use the loan amount for anything other than payroll costs, mortgage interest, rent, and utilities (i.e. electricity, gas, water, transportation, telephone, or internet access) payments over the 8 weeks after getting the loan an in place prior to February 15, 2020. Technically, up to 100% of the loan amount can be eligible for forgiveness, if spent on qualified expenses mentioned earlier during the eight-week loan period. However, the U. S. Treasury notes that you will be expected to spend at least 75% of any loan monies received on payroll; only 25% of the borrowed money can be spent on rent, mortgage, or utilities, if you want to apply for loan forgiveness.

Note: If you lay off additional employees after applying for the loan, your amount of loan forgiveness will be impacted. See Page 5 of this US Chamber of Commerce document for more details.

You will also owe money if you do not maintain your staff and payroll.

- Number of Staff: your loan forgiveness will be reduced if you decrease your full-time employee headcount.

- Level of Payroll: your loan forgiveness will also be reduced if you decrease salaries and wages by more than 25% for any employee that made less than $100,000 annualized in 2019.

- Re-Hiring: you have until June 30, 2020 to restore your full-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020.

How can I request loan forgiveness?

You can submit a request to the lender that is servicing the loan. The request will include documents that verify the number of full-time equivalent employees and pay rates, as well as the payments on eligible mortgage, lease, and utility obligations. You must certify that the documents are true and that you used the forgiveness amount to keep employees and make eligible mortgage interest, rent, and utility payments. The lender must make a decision on the forgiveness within 60 days.

What is my interest rate?

0.50% fixed rate.

When do I need to start paying interest on my loan?

All payments are deferred for 6 months; however, interest will continue to accrue over this period.

When is my loan due?

In 2 years.

Can I pay my loan earlier than 2 years?

Yes. There are no prepayment penalties or fees.

Do I need to pledge any collateral for these loans?

No. No collateral is required.

Do I need to personally guarantee this loan?

No. There is no personal guarantee requirement.

However, if the proceeds are used for fraudulent purposes, the U.S. government will pursue criminal charges against you.

What do I need to certify?

As part of your application, you need to certify in good faith that:

- Current economic uncertainty makes the loan necessary to support your ongoing operations.

- The funds will be used to retain workers and maintain payroll or to make mortgage, lease, and utility payments.

- You have not and will not receive another loan under this program.

- You will provide to the lender documentation that verifies the number of full-time equivalent employees on payroll and the dollar amounts of payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities for the eight weeks after getting this loan.

- Loan forgiveness will be provided for the sum of documented payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities. Due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs.

- All the information you provided in your application and in all supporting documents and forms is true and accurate. Knowingly making a false statement to get a loan under this program is punishable by law.

- You acknowledge that the lender will calculate the eligible loan amount using the tax documents you submitted. You affirm that the tax documents are identical to those you submitted to the IRS. And you also understand, acknowledge, and agree that the lender can share the tax information with the SBA’s authorized representatives, including authorized representatives of the SBA Office of Inspector General, for the purpose of compliance with SBA Loan Program Requirements and all SBA reviews.

Is this different from the SBA’s Economic Disaster Injury Loan (EIDL)?

The PPP builds on the existing framework of the SBA’s 7(a) loan program for small businesses. The Paycheck Protection Program loans will co-exist with the SBA’s Economic Disaster Injury Loans, so you’ll want to evaluate both programs to select which option, if either, is better suited for your business.

The details of this program are still developing and updates are being released daily if not hourly. Please note that we are not legal experts and recommend if you have specific questions about your business or loan application, speak with your attorney and/or bank for clarification and verification of this new legislation.

Additional Resources

- The Small Business Owner’s Guide to the CARES Act: a comprehensive guide to many of the small business provisions in the CARES Act

- U.S. Department of the Treasury CARES Act Assistance for Small Businesses Information

- U.S. SBA Paycheck Protection Program

- Coronavirus Aid, Relief, and Economic Security Act (CARES Act): What Small Businesses Need to Know

- Paycheck Protection Program (PPP): the SBA’s official webpage on the program

- Coronavirus Relief Options: in addition to traditional SBA funding programs, the CARES Act established several new temporary programs to address the COVID-19 outbreak